Managing money is one of the biggest challenges freelancers face. Irregular income, inconsistent client payments, and a lack of traditional financial infrastructure make budgeting harder than it is for most businesses.

The good news? There are now powerful financial tools for freelancers that help you plan budgets, create invoices, track expenses, automate taxes, and stay profitable — all without needing an accountant.

8 Top Financial Tools for Freelancers

Here are eight focused, high-ROI financial tools for freelancers to manage their money.

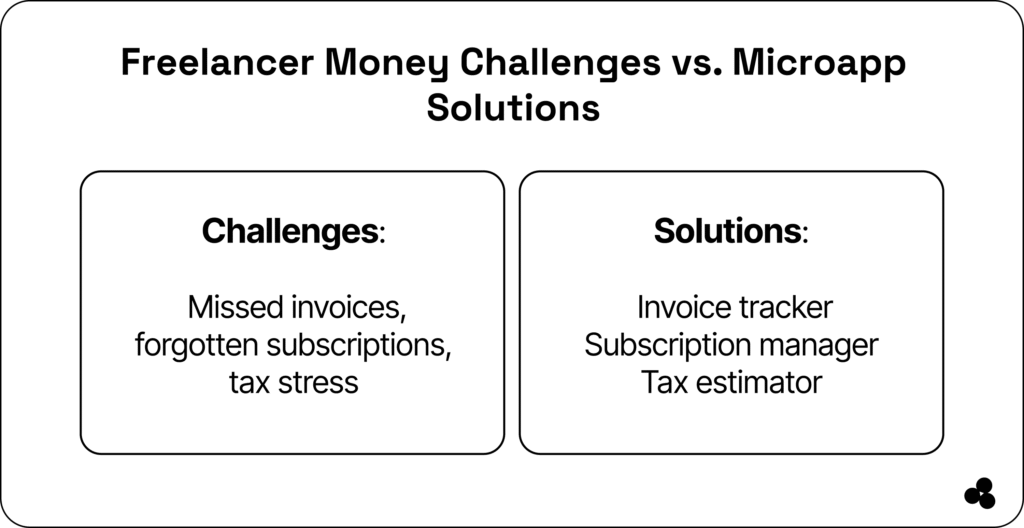

1. Powerful Invoice Tracker

Stay on top of client payments with an app that sends reminders, tracks due dates, and provides visibility into what’s been paid vs. what’s pending. You can even automate follow-ups and categorize invoices by client or project.

One job: Get paid faster.

Try it: Simple Invoice Tracker

👉 Combine it with an online generator tool

2. Smart Budget Planner

Build a personal or business budget in minutes with this financial tool for freelancers. Set monthly income goals, track fixed and variable expenses, and forecast your financial runway based on your freelance project pipeline. Visual dashboards help you spot overspending early.

One job: Know where your money’s going.

👉 Check out why budget planners work better as microapps.

3. Recurring Payment Reminder

Never get caught off guard by forgotten subscriptions or software auto-renewals. This app sends alerts before payments are due, helping you cancel or adjust plans on time.

One job: Stay ahead of bills.

4. Simple Tax Estimator

Input your freelance income and business expenses to get a quarterly and annual tax estimate. Useful for both U.S. and international freelancers preparing for tax season.

One job: Plan for taxes before they hurt.

5. Freelance Income Dashboard

Aggregate earnings from multiple clients or platforms (like Upwork, Fiverr, Stripe) into one place. See trends, calculate monthly averages, and set revenue targets.

One job: Understand your income patterns.

6. Project Profitability Calculator

Enter hours worked, expenses, and payments received for each project. Quickly see which clients or gigs are worth your time and which aren’t. Great for pricing strategy. One job: Maximize profit per project.

7. Expense Splitter

Freelancing with a partner? Splitting studio costs? Use this app to divide expenses fairly and avoid the hassle of creating and managing awkward spreadsheets. Adjust by percentage, date, or fixed amount.

One job: Split costs fairly.

8. Subscription Manager

Connect your bank or credit card, and this app auto-detects all your monthly charges. Highlight unused tools, track ROI, and cancel with a click.

One job: Cut wasteful subscriptions.

👉 Check out why spreadsheets are failing for finances and inventory teams.

Why Freelancers Need Focused Financial Tools

Many freelancers rely on spreadsheets, email reminders, and scattered software to track income, expenses, and taxes. But this scattered approach can cause:

- Missed payments or late invoices

- Confusion over expenses and reimbursements

- Stress during tax season

Focused financial tools for freelancers provide clarity and automation, giving you confidence that your finances are under control.

Why Financial Chaos Is a Top Startup Killer

According to CB Insights, 29% of startups fail due to cash shortages, often stemming from poor financial planning.

For freelancers and founders alike, disorganized money management leads to missed payments, untracked expenses, and burnout. In a world where time is money, the answer isn’t clunky enterprise software; it’s focused, flexible tools designed to do one job exceptionally well.

Welcome to the Microapp platform, your one-stop store for web apps where you can build financial tools for freelancers for speed, simplicity, and financial clarity.

👉 Are you looking for a more straightforward way to do your taxes? Discover the top tax software in 2025.

What Freelancers & Founders Need (Hint: Simpler Tools)

Most freelancers don’t need bloated software with 50+ features. As a freelancer, you need tools that do one thing well: invoice, budget, split, calculate, or alert.

That’s what makes microapps so effective as financial tools for freelancers: they’re purpose-built for focus and speed.

Instead of paying $50/month for a one-size-fits-all tool, you can pick or build exactly what you need and ignore what you don’t.

Microapps: The Smart Way to Manage Finances

Think of Microapp as your simple app builder for finance.

You can:

- Choose a ready-made microapp template

- Customize fields, visuals, and formulas

- Publish in minutes, with no engineering help

Every tool in this list can be built, edited, and launched directly from the Microapp platform. Even better: each is designed to excel at one specific task, from tax estimating to invoice tracking.

Do you have code? No problem with Microapp; you can upload an app without coding and build your no-code finance tools quickly to solve problems.

Once published, your tool will live on the App Store for web apps, making it discoverable by thousands of other users.

Turn Financial Microapps Into Passive Income

Do you have an idea for a better tax estimator? Budget tracker? Try building it in Microapp and listing it publicly. Many builders are earning income while they sleep by solving problems others face daily.

Use Microapp to:

- Earn money from side projects

- Build and sell niche tools

- Tap into passive income for developers

Need help? There’s a full Microapp tutorial to guide you.

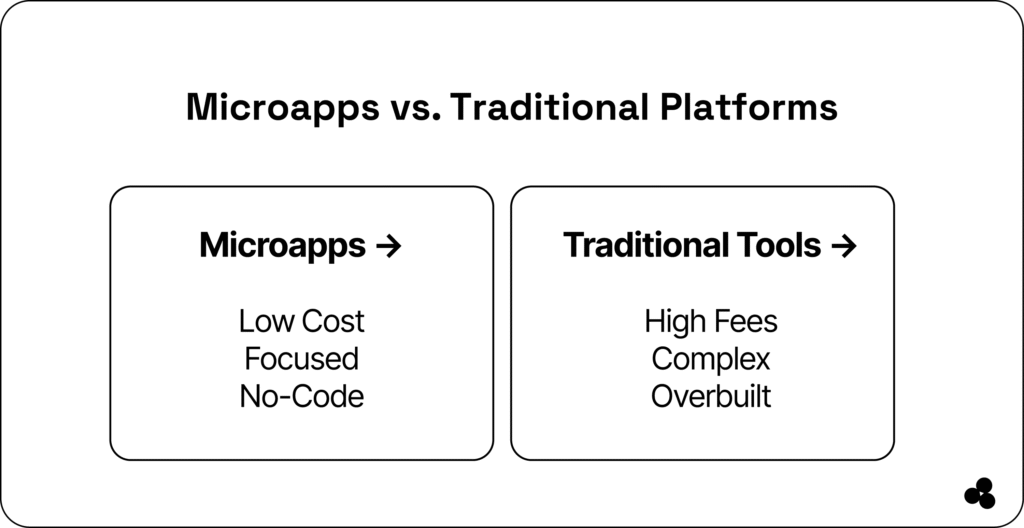

Comparison Table: Microapps vs Traditional Platforms

| Feature | Microapps | Traditional Tools |

| Build Without Code | ✅ | ❌ |

| One-Click Launch | ✅ | ❌ |

| Custom Financial Logic | ✅ | ⚠️ Limited |

| Cost | Low or Free | High Subscription Fees |

| Focused on Freelancers | ✅ | ❌ |

Take Control of Your Finances, One Microapp at a Time

You don’t need more tools. You need the right ones. Microapps offer a faster, cheaper, and more focused way to handle freelance finances, from budgeting tools for freelancers to invoice tracking apps and financial planning microapps.

🚀 Build your financial tools—fast, flexible, and made for freelancers. Microapp makes it easy to create and launch custom apps with zero code. Try it free today.

FAQs

Which fintech tools help with tax optimization for freelancers?

Tax estimation software and microapps designed for freelancers can help plan quarterly and annual taxes, minimizing surprises during tax season.

Are there micro-tools designed explicitly for freelancers’ finances?

Yes, financial microapps focus on a single task like invoicing, budgeting, or expense tracking, making them lightweight and easy to use. Platforms like Microapp Creator allow freelancers to build custom tools tailored to their workflow.

What freelance financial products can help manage business cash flow?

Freelancers can use budgeting apps, project profitability trackers, subscription managers, and income dashboards to monitor cash flow. These tools provide visibility into earnings, expenses, and upcoming bills to prevent financial stress.

How can freelancers manage recurring payments efficiently?

Subscription management tools and payment reminder apps alert you before bills are due and highlight unnecessary subscriptions. Combining these tools with Zoho Subscription Billing ensures you never miss payments.