If you’ve ever wondered “What is the time value of money and why does it matter?”, you’re not alone.

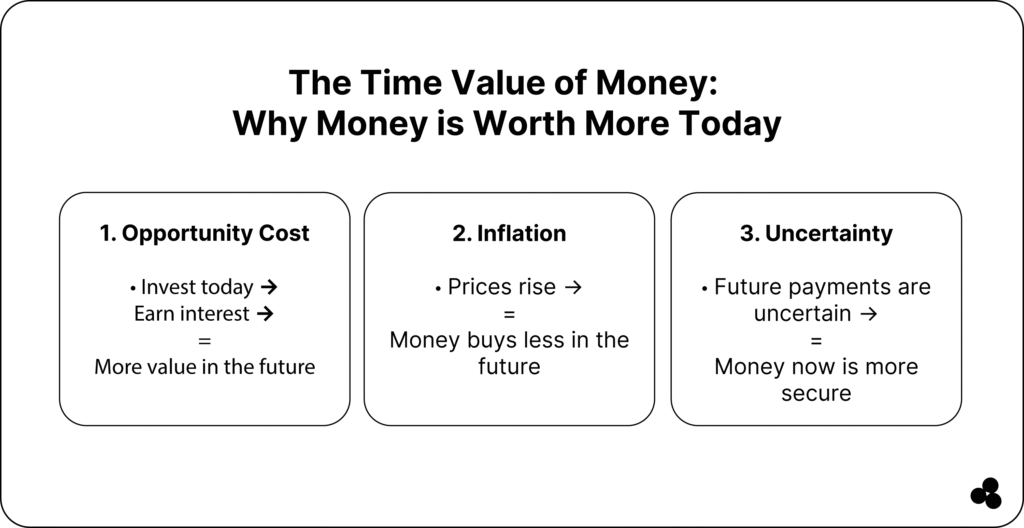

In simple terms, a dollar today is worth more than the same dollar tomorrow due to opportunity cost, inflation, and uncertainty.

Understanding TVM is essential for making smart business decisions, from investments to budgeting.

In this guide, we’ll break down the concept of TVM, explain its formulas, show practical business examples, and provide tools to help you apply it effectively.

💡 Quick Takeaway: Money today is more valuable than the same amount in the future because of opportunity cost, inflation, and potential earnings. Learning TVM helps you make better business, investment, and financial decisions.

What Is the Time Value of Money & Why It Matters

The time value of money (TVM) is a foundational principle in finance. It reflects the idea that money available today is worth more than money received later because it can be invested to earn a return.

Understanding TVM helps you as a business owner, investor, and manager:

- Compare cash flows at different times

- Decide between investment opportunities

- Plan budgets and resource allocation

For example, if someone offers you $1,000 today or $1,000 in a year, TVM shows that taking the money now allows you to invest it and earn interest, making it more valuable.

💡 Tip: Always consider TVM when planning projects or evaluating financial decisions. Learn more about strategic planning in Project Planning.

❓ Why does the time value of money matter for my business? TVM helps you compare present and future cash flows, make better investment decisions, and plan budgets efficiently.

Time Value of Money Formulas: Present Value, Future Value & How to Calculate

Understanding TVM requires knowing two key formulas: Present Value (PV) and Future Value (FV).

Future Value (FV)

The future value calculates how much an amount today will grow over time at a specific interest rate.

Formula:

FV = PV × (1 + r)^n

Where:

- PV = Present Value

- r = Interest rate per period

- n = Number of periods

Example: Invest $1,000 today at an annual interest rate of 5%. In 3 years:

FV = 1000 × (1 + 0.05)^3 = $1,157.63

Present Value (PV)

The present value determines what a future amount is worth today.

Formula:

PV = FV ÷ (1 + r)^n

Example: You expect $1,200 in 2 years and want to know its value today at 5% interest:

PV = 1200 ÷ (1 + 0.05)^2 = $1,088.44

💡 Tip: Using a TVM Calculator can simplify these calculations and save you time.

❓ How do I calculate the time value of money? Use the PV or FV formulas with the appropriate interest rate and number of periods. Tools like our TVM Calculator make this easier.

📚 Explore: The Best Tax Software for 2025.

Business Applications: How TVM Influences Smart Decision-Making

TVM isn’t just a theoretical concept — it drives real business decisions:

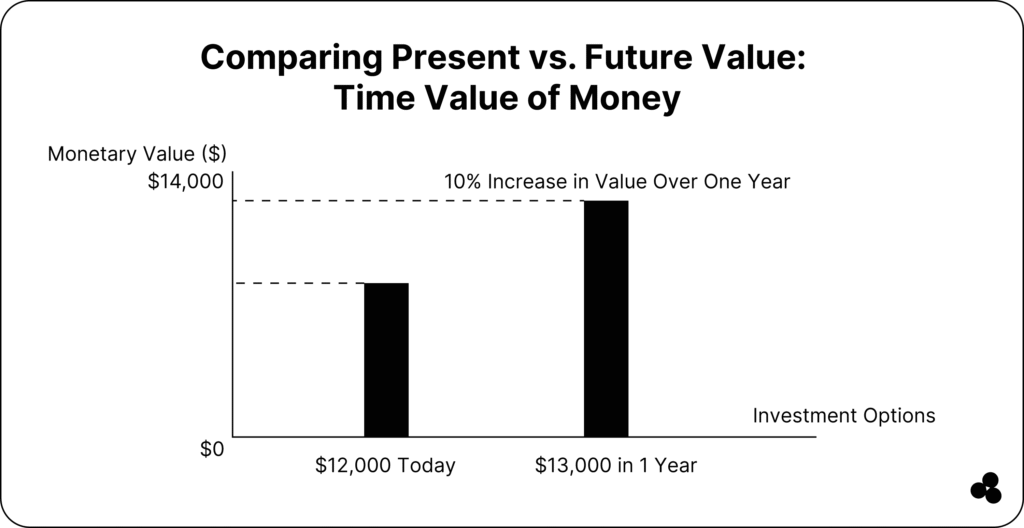

- Investment evaluation: Compare present and future cash inflows to pick profitable projects

- Budget planning: Prioritize expenditures with the highest value today

- Loans & financing: Understand the cost of borrowing over time

For example, deciding whether to invoice a client today or in 30 days impacts your cash flow and earning potential. Correctly applying TVM ensures your business decisions maximize value.

💡 Tip: Learn how invoicing affects cash flow in What Is an Invoice?

❓ What are the practical applications of the time value of money? TVM helps you make decisions about investments, project planning, budgeting, loans, and cash flow management.

Common Mistakes & Misunderstandings About TVM

Avoid these pitfalls when using TVM:

- Ignoring inflation: Failing to account for the decreasing value of future money

- Using the wrong rate or period: Miscalculating PV or FV leads to poor financial decisions

- Assuming all money is equally valuable: Timing and opportunity cost matter

💡 Tip: Always discount future cash flows to their present value to make accurate comparisons.

❓ Is a dollar today always better than a dollar tomorrow? In theory, yes, because of potential earnings, inflation, and uncertainty, but context matters for exact decisions.

How to Use TVM in Your Business Planning (Step-by-Step)

Here’s how to apply TVM to real-world business decisions:

- Estimate future cash flows – sales, savings, or investments

- Choose an appropriate discount/interest rate – consider inflation, risk, opportunity cost

- Calculate PV or FV – use formulas or a TVM Calculator

- Compare alternatives – e.g., invest now vs later, invoice today vs later

- Decide and act – implement the option with the highest present value

💡 Tip: Track cash flows with a Budget Planner App to make TVM calculations simpler.

❓ How often should I apply TVM in business planning? At every decision involving timing of cash flows — investments, invoices, contracts, or loan repayment. It is also helpful to keep this formula in mind.

Tools & Resources to Calculate TVM Quickly

Leverage tools to simplify TVM:

- Microapp TVM Calculator – for quick PV/FV calculations

- Budget Planner App – manage cash flows efficiently

- External learning: Financial Accounting course, HBS Online

- Additional reference: What Is a Good Profit Margin?

🧮 Tip: Integrating calculators and planning apps ensures you consistently apply TVM across business decisions.

Making Time Work for Your Money

The time value of money is more than a financial formula — it’s a roadmap for smarter business decisions. By understanding and applying TVM, you can:

- Maximize the value of your cash flows

- Make better investment and budgeting decisions

- Reduce financial risk and uncertainty

📊 Ready to make time work for your money? Start applying TVM with Microapp’s tools to monitor cash flows, optimize investments, and improve overall financial decision-making.